Black scholes online calculator

To use the calculator please complete the input fields. Brokerage calculator Margin calculator Holiday calendar.

Espen Haug

The data and results will not be saved and do not feed the tools on this.

. Online Black Scholes Calculator. Calculate european option prices with Black-Scholes Calculator you can easily get the. Use the buttons below the Expiration field for easy conversion from months to years 12 business.

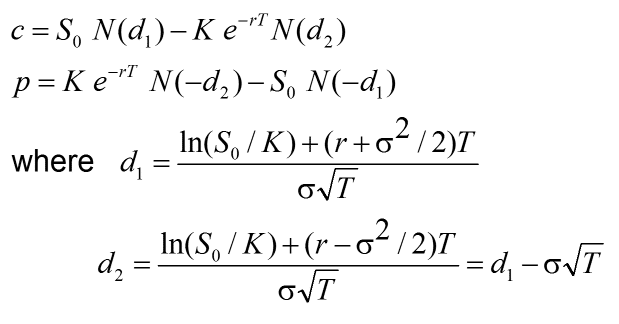

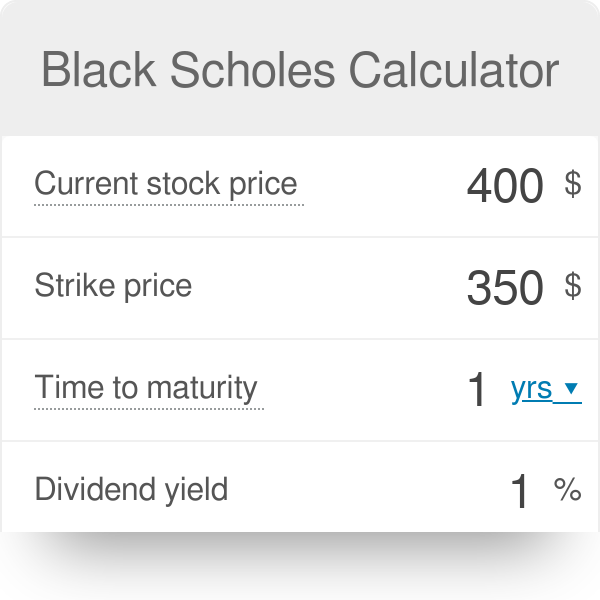

A Black-Scholes calculator is an online tool that can be used to determine the fair price of a call or put option based on the Black Scholes option pricing model. Black Scholes Option Pricing. The exercise price of the.

I dont want to solve your problems. Select callput in the dropdown box in cell C25 the. I have my own problems to solve I dont know why I should have to learn Algebra.

Online free financial black scholes calculator Get the price of call put buy and sell. Advanced Black-Scholes online calculator takes real market interest rate curve and can calculate American options. Black Scholes Option Pricing Model Calculator.

State the expected volatility of the stock ie 20. Z-Connect blog Pulse News Circulars Bulletin IPOs. This calculator uses the Black-Scholes formula to compute the price of a put option given the options time to maturity and strike price the volatility and spot price of the underlying stock.

To calculate a basic Black-Scholes value for your stock options fill in the fields below. It also acts as an Implied Volatility calculator. If you enter a Premium the Implied Volatility will.

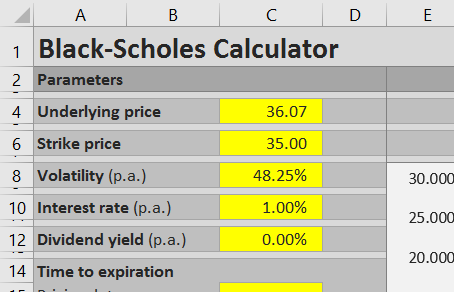

The most usual units are. The main variables calculated and used in the Black Scholes calculator are. Black Scholes calculator that easily instantly calculates the European-style stock options price.

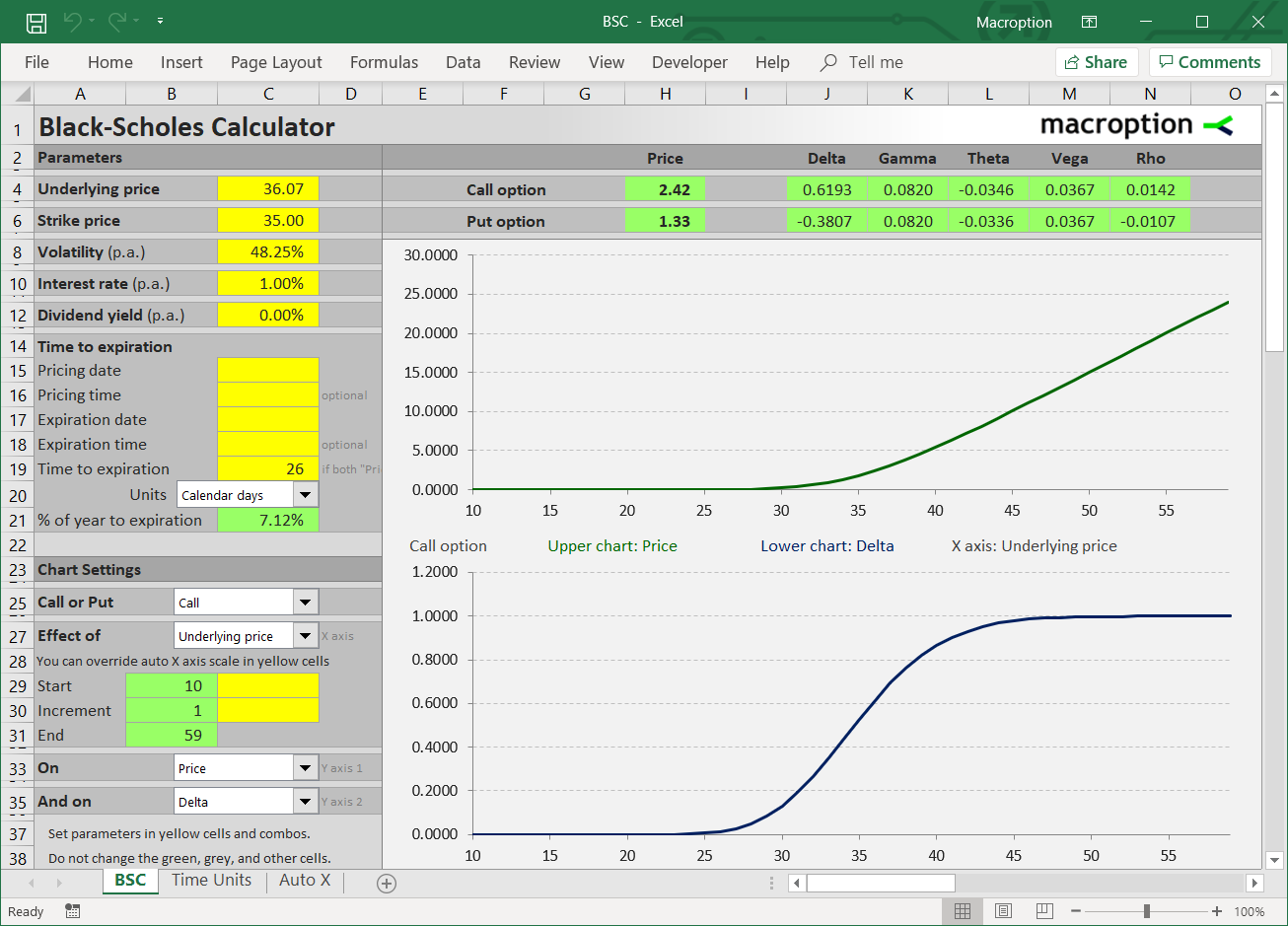

You can also display charts showing the impact of any of the 6 input parameters on any of the Greeks. You can fill every financial parameters to get the Black-Scholes results. One month 0083333 and rates in year.

Advanced Black Scholes calculator. Time in years eg. Spot Price SP Strike Price ST Time to.

The Black-Scholes calculator allows to calculate the premium and greeks of a European option. Volatility v Risk-Free Interest Rate r Dividend Yield d Call Price. This calculator uses the Black-Scholes option pricing model to calculate the fair value of a call option.

You have to enter the prices of. Im never likely to go. The Black Scholes option.

Input the expected dividend yield as 1. The price of the underlying asset or stock. An online BSM calculator is used to find out the european call value and european put value.

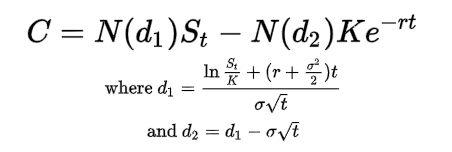

Calculate option premiums option greeks implied volatility of options using Quantsapp NIFTY option Calculator. The BlackScholes model develops partial differential equations whose solution the BlackScholes formula is widely used in the pricing of European-style options. Type the risk-free interest rate in percentage ie 3.

Black Scholes Calculator Sale 53 Off Www Ingeniovirtual Com

Black Scholes Calculator Factory Sale 58 Off Www Ingeniovirtual Com

Black Scholes Calculator Sale 53 Off Www Ingeniovirtual Com

Black Scholes Calculator Deals 59 Off Www Ingeniovirtual Com

/BlackScholesMerton-56a6d22e3df78cf772906866.png)

Black Scholes Model Definition

Options Does The Black Scholes Formula Work When Unit Of Time Is In Hours Quantitative Finance Stack Exchange

Black Scholes Calculator Factory Sale 58 Off Www Ingeniovirtual Com

Option Price Calculator American Or European Options

Espen Haug

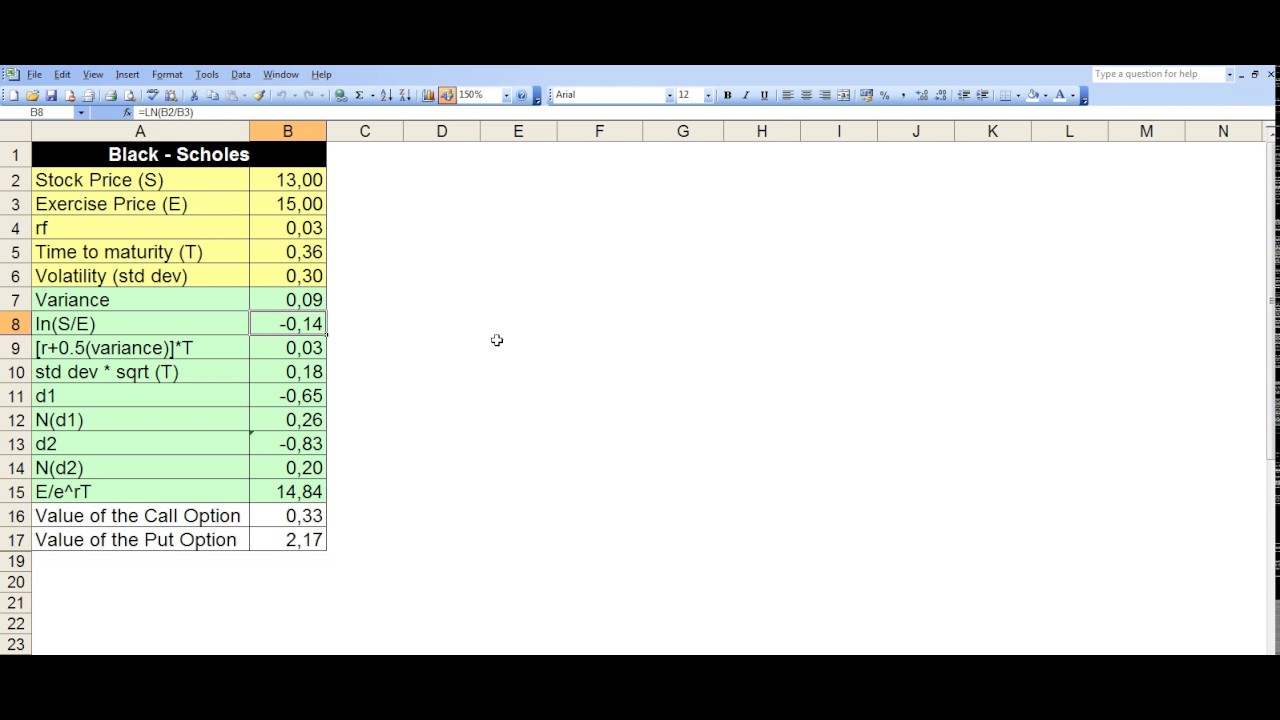

Black Scholes Model On Excel For Option Pricing Youtube

Black Scholes Calculator

Provide A Black Scholes Option Pricing Calculator Excel Template By Wade72 Fiverr

Black Scholes Option Pricing Model

Black Scholes Calculator Deals 59 Off Www Ingeniovirtual Com

Black Scholes Model In Python For Predicting Options Premiums The Startup

Espen Haug

Frm Using Excel To Calculate Black Scholes Merton Option Price Youtube